Currency of Rwanda

Rwandan Franc (RWF)

卢旺达首都

Kigali

卢旺达时区

GMT+2

Important Facts About the Country of Rwanda

Introduction to Rwanda

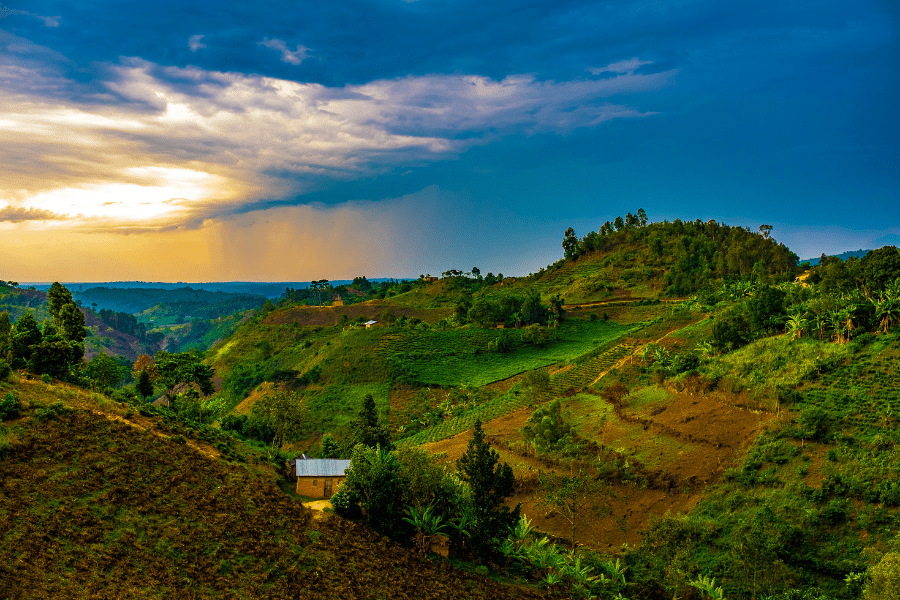

Rwanda is a country located in east-central Africa that is officially known as the Republic of Rwanda. It is landlocked and has a population of over 13 million people, which is one of the highest population densities in sub-Saharan Africa. Rwanda is famous for its stunning environment and is sometimes referred to as the “land of a thousand hills.” The capital and largest city is Kigali, situated in the heart of the country. Rwanda was colonized by Germany and Belgium in the 1880s and gained independence in 1962.

What to Know about Rwanda's Geography

Rwanda is the fourth-smallest country on the African continent, spanning a land area of 26,338 square kilometers. Rwanda, located a few degrees south of the Equator, is bordered by Uganda, Tanzania, Burundi, and the Democratic Republic of the Congo and is The entire country is at a high elevation, with rolling hills dominating the center.

Climate in Rwanda

Rwanda’s high elevation results in a temperate, tropical highland climate that has lower temperatures than what is typical for equatorial countries. The country’s temperature varies across different regions, with cooler temperatures found in the mountainous west and north compared to the lower-lying east. There are two rainy seasons in Rwanda, with the first occurring from February to June and the second from September to December.

The Culture of Rwanda

Music and dance are integral parts of Rwandan culture and are incorporated into various aspects of life, such as religious rituals, celebrations and social gatherings. Additionally, traditional trades like basket making, ceramics and metalwork are still practiced today, helping to preserve the country’s history and culture.

Religions Observed in Rwanda

Nowhere in Africa has Christianity had such a profound impact as in Rwanda. More than 57% of the population is Protestant, while more than 38% is Roman Catholic. Muslims, nonreligious people and members of other religious groups make up less than 5% of the population.

Languages Spoken in Rwanda

The official languages of Rwanda are Kinyarwanda, English, French, and Swahili. While English and French have historically been spoken by a small percentage of the population, English was designated as the language of educational instruction in 2008. Swahili, on the other hand, is widely spoken in urban areas and is the primary mode of communication with neighboring African countries.

Rwandese Human Resources at a Glance

Employment Law Protections in Rwanda

Labor Law No. 66/2018 of 30/08/2018, also known as the Law Regulating Labor in Rwanda, is the primary legal framework that governs employment relationships in the country. Additionally, other crucial legislations such as the Constitution of the Republic of Rwanda and the Social Security Code also play significant roles in the labor sector.

Employment Contracts in Rwanda

Employment contracts in Rwanda can be either oral or written but some contracts must be in writing, including those signed in Rwanda but implemented in foreign countries or those involving foreign employees working in Rwanda. The key elements of a written employment contract are determined by ministerial order.

If an employment contract is not in writing, its duration cannot exceed 90 consecutive days.

Contract Terms

An employment contract can be indefinite or fixed-term.

Rwanda's Fixed Term Contract Terms

Under Rwandan labor law, fixed-term contracts can be used to employ workers for tasks that are of a permanent nature. The law does not mandate a valid basis for using such contracts nor does it set a statutory limit on the maximum duration of successive fixed-term contracts. The contract’s defined duration can be renewed as many times as the parties agree.

If a fixed-term contract is not renewed in writing after its expiration, but the employee continues to work, the compensation will be based on the number of days worked.

Pre-Employment Checks

Pre-employment checks are permitted to ensure a clean criminal record and suitability for the job.

Rwanda's Guidelines Regarding Probation Period/Trial Period

The probation period for employees in Rwanda cannot exceed three months. However, the employer can extend the period by up to three months for valid reasons, as long as the employee is provided with a written review of their performance.

If an employee’s written performance review during the probation period shows they are not competent and they are notified of this, the employer has the right to terminate the employment contract without giving notice. The employee is only entitled to the salary they have earned and no other compensation will be paid out.

Regulations and Rules Regarding Working Hours in Rwanda

The maximum working hours are 45 hours per week. Employees are entitled to at least 24 consecutive hours of rest per week. The weekly rest period normally takes place on a Sunday.

Rwandese Laws Regarding Overtime

Overtime rates are negotiated between the employer and the employee. This will be determined in the employment contract.

Rwandese Timesheets

Rwanda’s labor laws state that the daily timetable for work hours and breaks for an employee is determined by the employer.

Termination

In Rwanda, employers can terminate an employment contract either by observing the notice period requirements or by providing payment in lieu of notice.

However, if an employee engages in gross misconduct, the employer has the right to terminate the employment contract without notice. In such cases, the employer must notify the employee within 48 hours of obtaining evidence of the misconduct.

It is unlawful for the employer to terminate the employment contract if the employee is suspended or on leave.

If an employer unlawfully terminates the employment contract, the employee is entitled to compensation for damages. The range of damages must be between three to six months’ salaries. In case the employee has 10 years of experience, the maximum amount of damages is nine months’ salary.

Rwanda's Requirements Regarding Notice Periods

- At least 15 days when an employee has served for less than one year

- At least 30 days when an employee has served for over one year

The notice must be given in writing and state the reasons for termination of the employment contract.

During the notice period, the employee is allowed to be absent from work for one day per week to search for a new job.

Redundancy/Severance Pay in Rwanda

Severance pay is calculated based on seniority at the following rates:

- Two times the average salary for less than five years of service

- Three times the average salary for five to 10 years of service

- Four times the average salary for 10 to 15 years of service

- Five times the average salary for 15-20 years of service

- Six times the average salary for 20-25 years of service

- Seven times the average salary for more than 25 years of service

To calculate the average monthly salary, the employee’s total salary for the past twelve months (excluding any allowances given for work-related purposes) is divided by 12. Once an employment contract is terminated, any related benefits must be paid within seven working days.

Post-Termination Restraints/Restrictive Covenants

In Rwanda, there are no specific regulations on the validity and enforceability of non-compete provisions in employment contracts. Most employers can enter into confidentiality agreements with employees to prevent the disclosure of sensitive information.

Data Protection

In Rwanda, Law No. 058/2021 Relating to the Protection of Personal Data and Privacy governs data protection. This law mandates that employers must obtain explicit consent from employees for processing their personal data and must clearly state the specific purpose for which the data will be used.

Tax and Social Security Information for Employers in Rwanda

Personal Income Tax in Rwanda

Employers are required to withhold, declare and remit the pay-as-you-earn (PAYE) tax to the tax authority within 15 days following the end of the month for which the tax was due.

The below tax brackets apply to employment income.

Effective in 2023:

| Monthly Taxable Income (RWF) | Tax Rate % |

|---|---|

| 0 – 60,000 | 0 |

| 60,001 – 100,000 | 20 |

| 100,001 and above | 30 |

Effective in 2024 and beyond:

| Monthly Taxable Income (RWF) | Tax Rate % |

|---|---|

| 0 – 60,000 | 0 |

| 60,001 – 100,000 | 10 |

| 100,001 – 200,000 | 20 |

| 200,001 and above | 30 |

Social Security in Rwanda

The Rwanda Social Security Board (RSSB) oversees the administration of the national social security schemes in the country, which applies to both Rwandan citizens and foreign workers. To participate in the scheme, employees and employers are required to contribute, with the amount of contribution based on the employee’s gross monthly salary. Employers are responsible for collecting and remitting the contributions to the Rwanda Revenue Authority (RRA) by the 15th day of the following month.

| Type | Employer Contribution Rate (%) | Employee Contribution (%) |

|---|---|---|

| Pension Scheme | 3 | 3 |

| Occupation Hazards | 2 | NA |

| Maternity Fund | 0.3 | 0.3 |

Important Information for Rwandese Employees

Salary Payment

Salaries must be paid on time and in legal currency. The maximum payment interval must not exceed:

- One day for an hourly or daily worker

- One week or two weeks for a weekly or biweekly worker

- One month for a monthly worker

Employers must pay their employees’ salaries within seven days after the end of each pay period. However, if the employee is a daily worker, they must be paid every day. The employer must deposit the employee’s salary into a bank or financial institution account that the employee has specified in writing.

Payslip

An employer is required to provide a payslip to an employee upon request. The payslip should include information on how the employee’s compensation was calculated, such as their basic salary, any allowances or bonuses as well as the amount of taxes withheld. The payslip should also indicate the employee’s net salary.

Annual Leave

After completing one year of continuous service, employees in Rwanda are entitled to 18 days of paid annual leave. This entitlement increases to 21 days of paid annual leave after three years of continuous service with the same employer.

Sick Leave

Employees are entitled to 15 days of paid sick leave upon presenting a medical certificate from a licensed doctor. In the event that the sick leave period exceeds 15 days, the employee can apply for long-term sick leave, which can last for up to six months. However, the approval of a medical committee composed of three licensed doctors is required for long-term sick leave. The employee is entitled to full salary for the first three months of the leave. After three months of paid sick leave, the employee can request another three months of unpaid work suspension.

It is important to note that the employer has the right to terminate the employment contract if an employee remains ill after six months of long-term sick leave.

Circumstantial Leave

Employees in Rwanda are entitled to the following circumstantial leaves to deal with both fortunate and unfortunate events that occur within their families.

- two working days in case of his or her civil marriage;

- one month in addition to paternity leave days in case his wife dies leaving an infant of less than three months;

- seven working days in case of death of his or her spouse;

- five working days in case of death of his or her child or adoptive child;

- four working days in case of death of his or her father, mother, father-in-law, or mother-in-law;

- four working days in case of death of his or her brother or sister;

- three working days in case of death of his or her grandfather or grandmother;

- three working days in case of his or her transfer over a distance of more than 30 kilometers from his or her usual place of work.

An employee on circumstantial leave continues to receive their salary and fringe benefits. Circumstantial leave cannot be divided into installments or deducted from annual leave.

Maternity Leave

Maternity Leave

Female employees are entitled to 14 weeks of paid maternity leave, which includes two weeks before delivery. If a female employee experiences complications during childbirth or if their child has a medical issue related to the delivery, and it is confirmed by a recognized medical doctor, the employer must grant an additional paid leave of up to one month for the mother.

Following their return to work, new mothers are allowed a daily one-hour breastfeeding break for up to 12 months. The break is deducted from the total working hours and fully compensated.

Paternity Leave

A male employee is entitled to seven calendar days of paternity leave in the event of his wife’s delivery.

Public Holidays

The Rwandan government sets the official public holidays each year through a presidential order. Typically, there are 11 public holidays observed in Rwanda annually.

If an employee works on a public holiday, they are entitled to compensatory rest that is equal to the number of public holidays worked over the preceding 30 days.

Benefits to the Employee in Rwanda

Rwandese Statutory Benefits

Employees in Rwanda are entitled to receive pension insurance, worker injury insurance, maternity leave benefits, paid annual leave, paid sick leave and paid circumstantial leave.

Other Benefits

- Motor vehicle allowances

- Loans at a lower interest rate

- Housing allowance

- Phone allowance

Rules Regarding Visas and Foreign Workers in Rwanda

General Information

Citizens of Angola, Benin, Central African Republic, Chad, Cote d’Ivoire, The Federation of Saint Christopher and Nevis, Ghana, Guinea, Indonesia, Haiti, Mauritius, Philippines, Senegal, Seychelles, Sierra Leone, Sao Tome and Principe, Singapore and the State of Qatar can receive a free 90-day visa upon arrival.

For citizens of non-visa-exempt countries, there is an option to apply for a visa online or at the Rwandan embassy or consulate in their home country before departure. Online applicants can choose to pay for their visa online or upon arrival.

Work Permits

In addition to visas, expatriates planning to work in Rwanda must apply for work permits.

Work permits in Rwanda are separated into temporary and permanent categories. Various types of permits are available depending on the reason for the stay. For instance, below are some types of temporary permits that for employment purposes:

- A skilled worker on an occupation on demand (H1)

- A skilled worker sponsored by an organization (H2)

- Journalist or media (H3)

- Semiskilled or artisan(H4)

- International Organization staff (H5)

- Foreign employees based on a special agreement or a reciprocity basis (H6)

The validity period for work permits is up to two years.

A collection of pertinent documents in either French or English are required to complete the application and obtain a work permit.

Public Holidays Recognized by Rwanda in 2024

| Occasion | Date | |

|---|---|---|

| 1 | New Year’s Day | January 1 |

| 2 | Day after New Year’s Day | January 2 |

| 3 | National Heroes Day | February 1 |

| 4 | Good Friday | March 29 |

| 5 | Easter Monday | April 1 |

| 6 | Genocide against the Tutsi Memorial Day | April 7 |

| 7 | Independence Day | July 1 |

| 8 | Liberation Day | July 4 |

| 9 | Umuganura Day | August 2 |

| 10 | Assumption Day | August 15 |

| 11 | Christmas Day | December 25 |

| 12 | Boxing Day | December 26 |